You might think that anyone buying gold today must wait for next picture the Fed of quantitative easing to create hyperinflation and you could be right.?

Just as in the 1930s, presents a deflation invites aggressive banks centrales.Achat logic gold inflation fears if you expect the ECB to succeed all too well.

Performance gold itself, however, cannot be step depend on further devaluation of the dollar.Do not according to the Japanese experience, at least.

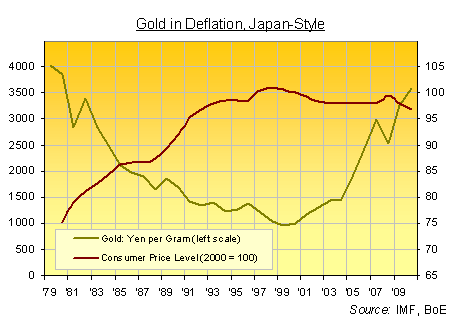

Yes, yen gold prices came alongside gains significant-even in the dollar gold price .Comme our chart shows, the consumer price inflation is not a prerequisite for a bull market in gold.

Indeed, an increase in cost of living in the 1980s and 1990s saw the value of the yen to fall gold, 75% on this stretch of 20 years.

Subsidence rates of interest, on the other hand, made or an alternative links for Japan at the beginning of the last ten years, investors such as bankruptcies augmenté.Contrairement debt, or not can be broken .puisqu ' it pays already zero interest, it may not pay you less to take over in the middle of the déflation.Et credit risk is only growing as flexible Japan, slow depression door.

This entry transmitted via the service for full-text RSS - if this is your content and you read on someone to another site, please read our FAQ page fivefilters.org/content-only/faq.php

Article five filters features: After Hiroshima - non-rapport Cancer Catastrophe of Fallujah.

No comments:

Post a Comment